Mortgage calculator with annual lump sum payments

In a year you might receive lump sum payments in the form of an annual work bonus or a windfall from a business venture. The main difference between a lump-sum and a monthly payment is that with a lump-sum option you get to have control over how your money is invested and what happens to it once youre gone.

Mortgage Calculator Joan Killian Everett Company North Carolina Real Estate

Your loved ones would receive a lump-sum payment if you died and depending on your cover could receive.

. Whatever the frequency your future self will thank you. But keep in mind that a lump sum pension payout makes it easier to overspend in retirement. A lump sum is finite while monthly pension payments continue at.

Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. Fortunately these annual payment fluctuations will probably be minor relative to an ARMs interest rate resetting or an interest-only period ending. 30-Year Fixed Mortgage Principal Loan Amount.

Using our mortgage rate calculator with PMI taxes and insurance. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Most banks offer some form of mortgage payment deferral to help homeowners during difficult financial periods.

Biweekly monthly quarterly or annual payments along with one-off lump sum contributions. How our mortgage calculator works. Especially with rates even the most minute change can have a big impact on your estimated mortgage payments.

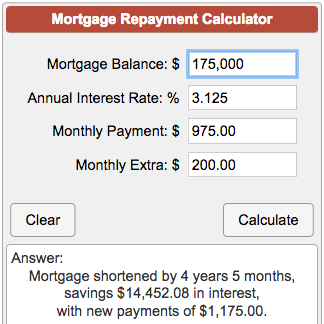

When a Lump-Sum Payment Makes Sense. You can make a lump sum payment once a year. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

For example lets assume you have 50000 in student loans at a 7 interest rate. Make sure you enter the frequency of contribution you would like to make when the contribution begins and. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

Mortgage Amount or current balance. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. Make more frequent payments.

Formula to calculate your monthly mortgage payments. If you do this each year you can significantly reduce your term and interest charges. If thats the case then the lump-sum option is your best bet.

The mortgage amortization schedule shows how much in principal and interest is paid over time. You can save significant money on your student loans with a lump sum payment. Lets assume you make a one-time lump-sum payment of 1000.

It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance. Annual Lump Sum Equal to a 13th Payment.

Is approaching 400000 and interest rates are hovering around 3. This is the best option if you plan on using the calculator many times over the. Here are some ways to know whether making a lump-sum mortgage payment is the best option for you.

See how those payments break down over your loan term with our amortization calculator. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes. If you have this information available you can enter the annual percentage rate APR which includes interest and fees combined.

To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. But like many personal finance decisions its a matter of choosing between a good option and a better option. N the number of payments over the.

But they dont include any other fees or payments you may need to make. Recurring extra payments add up to reduce your principal balance. But if you have large funds you can use it to decrease a considerable portion of your loan.

Note that your monthly mortgage payments will vary depending on your interest rate taxes PMI costs and other related fees. You can also use the calculator on top to estimate extra payments you make once a year. Taking advantage of particular prepayment privileges that some mortgage lenders offer such as RBCs Double-Up prepayment option or BMOs 20 annual lump-sum prepayment option will also reduce your amortization period.

You can typically elect to begin making the higher mortgage payment to cover the shortfall or pay a lump sum to boost your escrow account reserves so your monthly payment wont change. There are a few drawbacks of the lump sum payout option. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal.

While most homeowners only make 12 payments annually you can make a lump sum payment equivalent to a 13th payment on your mortgage. You can even combine multiple extra payments in a single calculation. To get the most accurate mortgage report enter as many relevant fields as possible.

The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. While our calculator takes the computing out of your hands math whizzes can do it themselves with the following formula. Our mortgage calculator supports four types of extra payments one-time lump sum payments recurring monthly quarterly or yearly extra payments.

This is the best option if you are in a rush andor only plan on using the calculator today. The information below shows roughly how your monthly payments will affect your mortgage balance over time. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US.

You can use a lump sum extra payment calculator to calculate how much money you can save with a lump sum payment. In most cases the lump-sum option is clearly the way to go. That new car or luxurious vacation may not seem like such a splurge when youre looking at a six- or seven-figure bank account.

Interest rate which should be divided by twelve corresponding to the months of the year since lenders give an annual rate. Paying down debt is rarely a bad idea. Make Lump Sum Loan Payments.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Mortgage Calculator For Excel

Interest Only Mortgage Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Excel Formula Estimate Mortgage Payment Exceljet

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Extra Payment Calculator Is It The Right Thing To Do

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator Money

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Repayment Mortgage Calculator Factory Sale 50 Off Www Wtashows Com

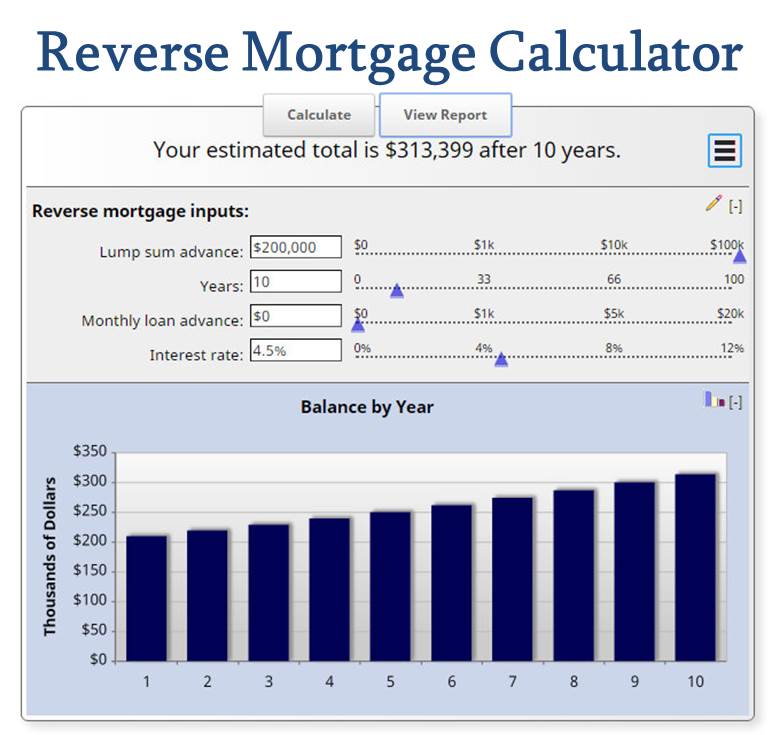

Reverse Mortgage Calculator Discover If It Makes Sense

Downloadable Free Mortgage Calculator Tool

Mortgage With Extra Payments Calculator